IAPQR Transactions - A UGC-CARE Listed Journal

Published in Association with Indian Association for Productivity, Quality and Reliability

Current Volume: 49 (2024-2025 )

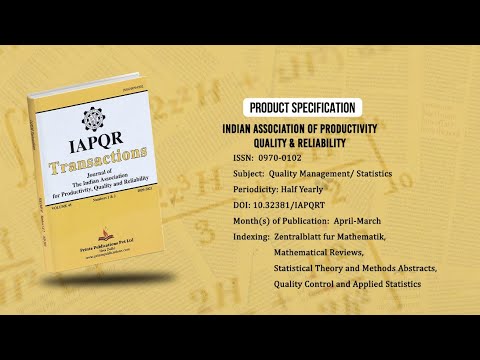

ISSN: 0970-0102

Periodicity: Half-Yearly

Month(s) of Publication: September & March

Subject: Quality Management/Statistics

DOI: 10.32381/IAPQRT

Balancing Cost, Performance and risk in Maintenance and Capital Expenditure

By : Gopinath Chattapadhyay

Page No: 107-126

Abstract

Asset Management is focused on realisation of value from assets through managing risk and opportunity. ISO standard for asset management ISO55000, 2014 stipulates effective control and governance of assets for desired balancing act of cost, performance and risk. This paper aims to study the maintenance and capital expenditure problems. It proposes how to balance cost, performance and risk for asset management. Decisions need to be based on performance and risk in addition to costs based on whole of life are supported by international standards for asset management. Option analysis and informed decision-making are proposed considering life cycle costs. Recent trend with industries is to align with latest international standards for asset management. Asset management in heavy haul rail network focuses on this by realisation of value from assets through managing risk and opportunity. Model for total cost of maintenance was developed covering risk costs associated with undetected surface/ subsurface cracks causing rail breaks and derailments and wear loss due to gauge face lubrication problems and intervention costs in inspections and interventions using progressive rail grinding and solar powered electric lubricators with remote performance monitoring. Illustrative examples are used to show how actions in inspection and subsequent rail grinding for controlling rolling contact fatigue (RCF) along with gauge face lubrication for controlling wear can be achieved in heavy haul railway. This maintenance and capital investment policy and decisions based on life cycle cost models can be used as reference for capital expenditure (capex) and operational expenditure (opex) balancing in any industry in general and heavy haul in particular.

Author :

Gopinath Chattopadhyay

School of Science Engineering and Information Technology, Federation University Northways Road, Churchill, PO Box 3191, Gippsland Mail Centre, Vic 3841.

DOI: DOI-https://doi.org/10.32381/IAPQRT.2020.44.02.1